DRAM Market Will Experience Severe Shock in 2025: Global Supply Chain Is Hit by a Wave of Price Hikes and Shortages

The collective shutdown of three major manufacturers triggers a chain reaction in the supply chain, prolonging the elimination cycle for niche demand.

Overview of Key Events

In the first half of 2025, the global DRAM memory market faced a structural supply crisis. The three major players, Samsung, SK Hynix, and Micron, simultaneously reduced their production capacity of DDR4 and shifted to the production of high-profit DDR5 and HBM (High Bandwidth Memory), resulting in a sharp decline in the supply of DDR4 chips and a price surge of over 50%. The spot markets in places like Huaqiangbei were in a situation where "every piece of the product was hard to obtain".

Key Factors Causing Imbalance between Supply and Demand

1. Strategic Withdrawal by International Major Manufacturers

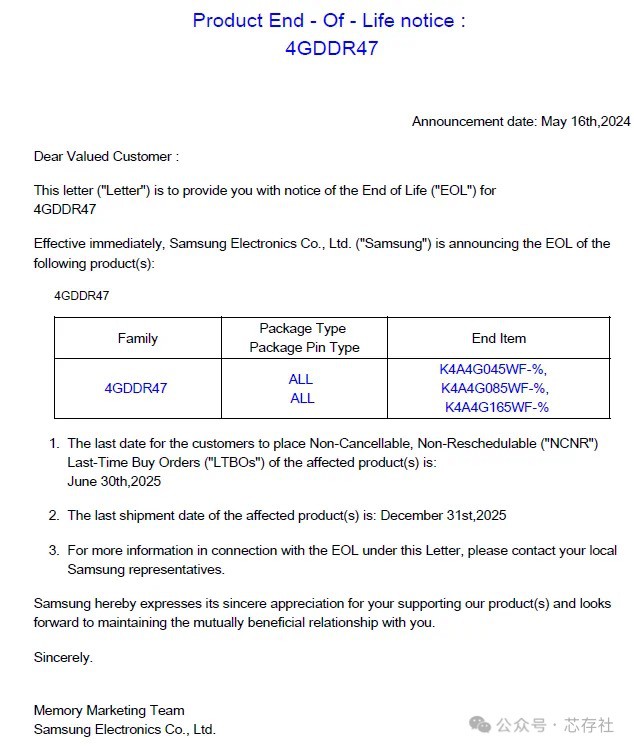

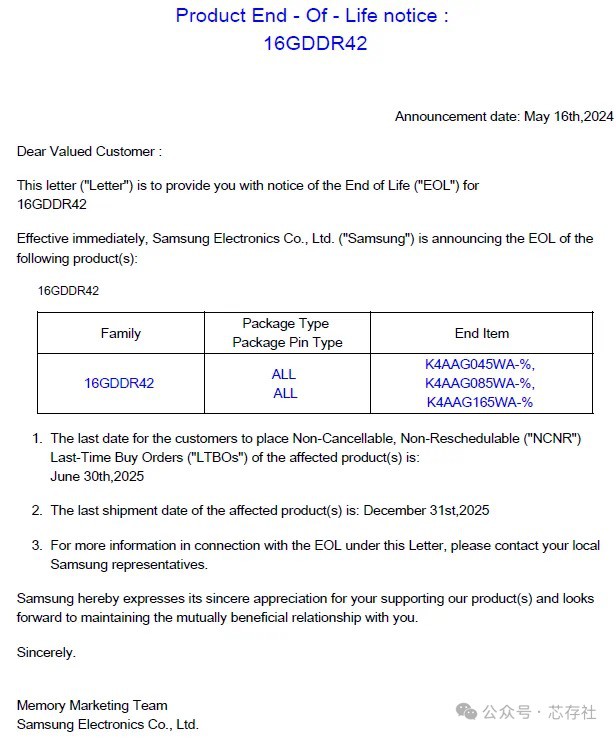

- Samsung: Issued a notice to cease production of DDR4 in April 2025, retaining supply only for automotive/industrial customers. By June, supply from the channel had been effectively halted. The spot price of 8GB DDR4 soared to $4.8 (an increase of 45%).

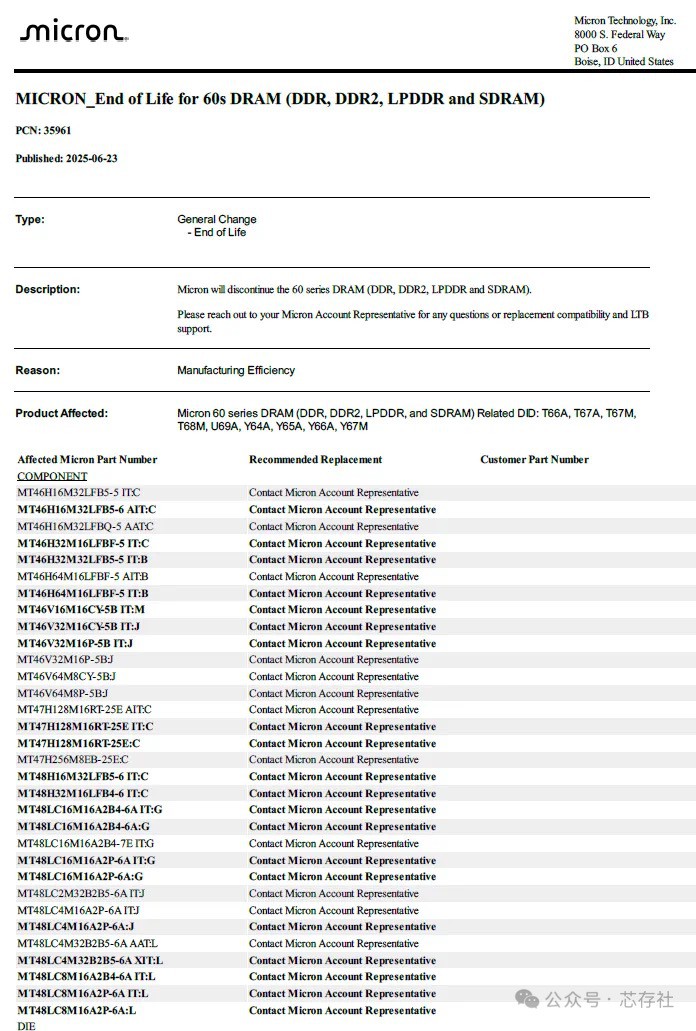

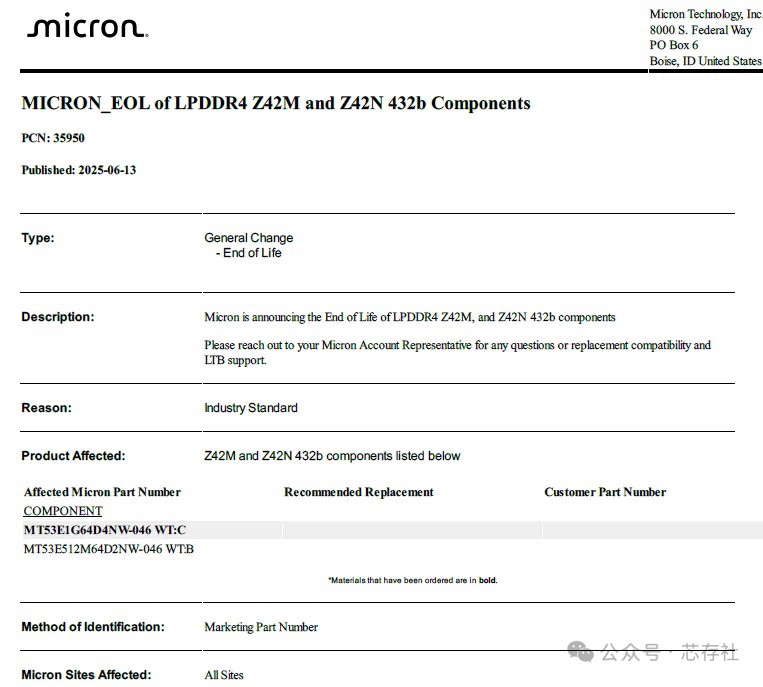

- Micron : The price of DDR4 jumped by 50% in June. The verification period for industrial customers was prolonged, exacerbating the shortage.

- SK Hynix : Reduced DDR4 production capacity to below 20%. It will completely cease production in April 2026.

2. The demand for AI is squeezing out traditional production capacity

- Due to the surge in demand for AI servers, HBM has monopolized 20%-26% of the production capacity of the three major manufacturers. The order schedule for HBM3E has been extended until 2026, further reducing the resources for DDR4.

- The rapid penetration of DDR5: DDR5 accounts for 70%-80% of the PC/server market. Interface chip manufacturers such as Leagile have seen a significant increase in orders (Q2 orders exceeded 1.29 billion yuan).

Market Impact: Price Inversion and Industry Chain Shock

- Price Fluctuation :

- In May, the price of DDR4 chips jumped by 50% in half a month. The price of 16GB in stock reached $6, outperforming the price of DDR5 of the same specification (5.8 USD) , creating a rare "generation inversion" phenomenon that has not occurred for a decade.

-Terminal products followed the trend: The price of bare DDR4 16GB from Huaqiang White Brand rose by 30% in a week, and the price of the same model on JD.com soared from 197 USD to 267 USD within a week.

- Shortage Spread :

- Merchants in Huaqiangbei, Shenzhen, generally reported that there was no stock of DDR4 in multiple specifications. Module factories were forced to switch to DDR5 or domestic solutions.

-The industrial sector was severely affected: 80%-90% of industrial control equipment still relied on DDR4, and the long certification cycle made it impossible to replace in the short term.

Structural Contradiction: Eliminating Lagging Technologies and Domestic Opportunities

1. Niche Markets Support Long-Term Demand

- In scenarios such as TVs, security systems, and vehicle-mounted devices, there is a rigid demand for the stability of DDR4:

- Meguiar's Innovation's shipment volume of DDR4 in the TV sector has doubled, and Dongxin Shares predicts a 5%-7% annual growth in the niche market.

- Industry predictions: It will take 3-5 years for DDR4 to completely retire, and short-term shortages are difficult to resolve.

2. Domestic Supply Chain Accelerates Its Role

- Changxin Storage : In 2024, the shipment volume of DDR4 increased by 55% year-on-year, and its global share exceeded 5%. The price of domestic memory chips in Huaqiangbei was 100 yuan lower per piece compared to international brands.

- Rise of Technical Support:

- Baivvi Storage has mass-produced 8200Mbps DDR5 overclocked modules and LPDDR5X (for AI mobile phones);

- Lanqi Technology's DDR5 interface chip had a year-on-year profit increase of 135% in the first quarter.

Trend Outlook

- Price Trend : The contract price of DDR4 is expected to increase by 18%-23% in Q3 (for servers) and 13%-18% for PCs. The hoarding trend may continue until the end of the year.

- Transformation Suggestions :

- Consumer sector: Prioritize the DDR5 platform (AMD Ryzen 7000/Intel 13th generation and above);

-Industrial control scenarios: Adopt domestic DDR4 solutions (Changxin/Microchip Innovation) to reduce costs and mitigate risks.

Industry Warning : This round of crisis has exposed the supply chain vulnerabilities in the semiconductor generational transition. In the next three years, the competition for production capacity between HBM and DDR5, the technological transition in niche markets, and geopolitical policies (such as US tariffs) will be the three major uncertain variables in the memory market.The following are the EOL notifications of various brands:

(This article is based on the comprehensive analysis of the publicly available market data as of June 2025.)

The following are the EOL notifications of various brands: